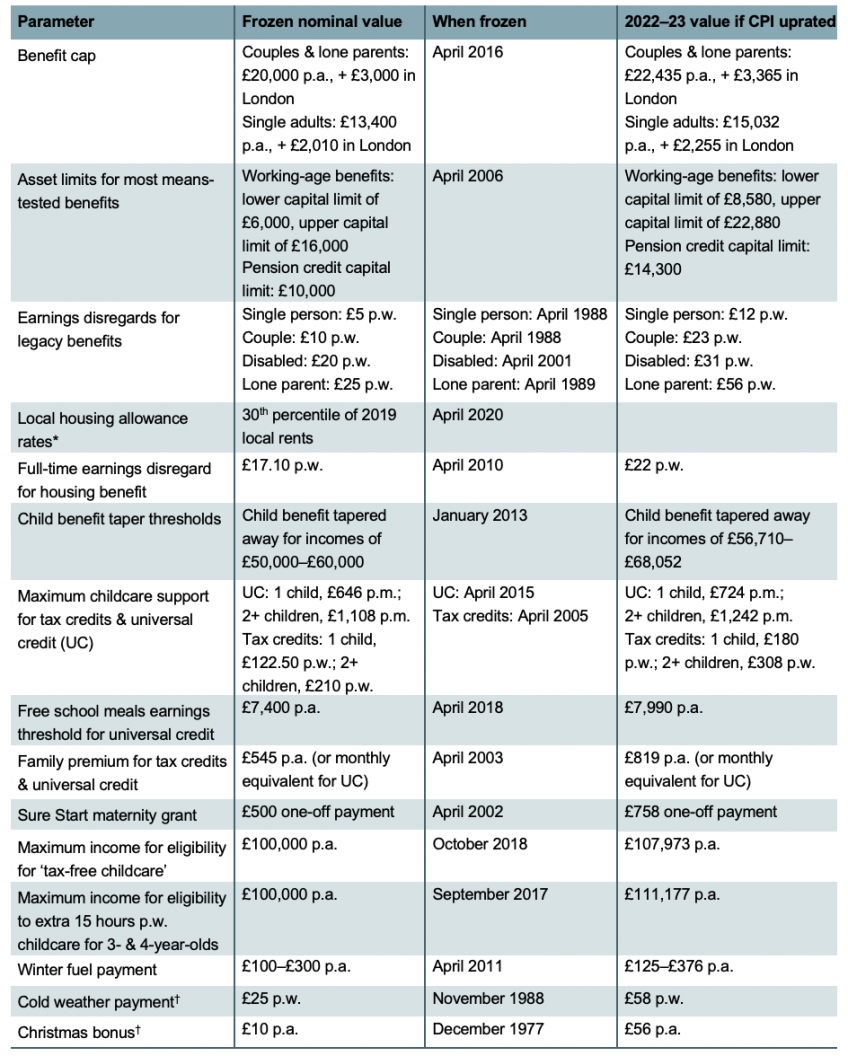

What is the new benefit cap and will it affect me? The 'disgraceful' Tory cut explained - Mirror Online

Arun Advani on X: "Latest @HMRCgovuk #capitalgains stats out. *Big* jump in number and amount of gains (c20%), and in tax paid (42%). Jump in gains bcos ppl worried abt CGT reform

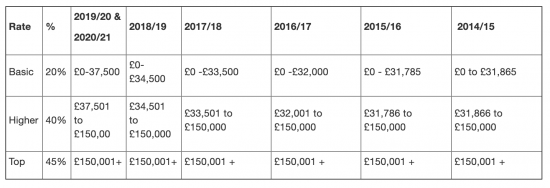

UK Tax Rates, Thresholds and Allowances for Self-Employed People and Employers in 2024/25 and 2023/24 | The Accountancy Partnership

Tax After Coronavirus (TACs) : Reforming taxes on wealth by equalising capital gains and income tax rates

Company Founders Beware! HMRC's PAYE Cap Trap - R&D Relief & Tax Credits for Seed or Pre-Seed Start-Ups

UK Tax Rates, Thresholds and Allowances for Self-Employed People and Employers in 2024/25 and 2023/24 | The Accountancy Partnership